Valuation & due diligence report for a polyclinic in KSA based on market assessment, financial assessment and analysis

Client / Industry Brief

- The client is interested in acquiring a polyclinic at an estimate acquisition of 10x of the net profit of 2018, through focusing on the key revenue drivers, profitability drivers and potential for future improvement.

- The healthcare sector in KSA has evolved substantially over the years, especially, due to increasing demand drivers such as aging population, unhealthy eating, smoking and sedentary lifestyle has become a prominent part of the KSA demography.

Project Objectives

- Developing the required context and gathering management inputs from internal stakeholders and promoters on the current operations, challenges and future vision for the poly clinic.

- Validation of inputs received from the management, finance and current operation team based on the HIS system.

- Draw inferences from financial analysis and identify key value drivers to plot the current valuation for the polyclinic which can be used as a reference for value-unlocking initiatives.

- Identify the gaps in the current operations and categorize them into specific ‘gap themes’ of varying priorities based on their impact on the shareholder value. Also, identify KPIs that can be used to track the implementation of the recommended changes/initiatives.

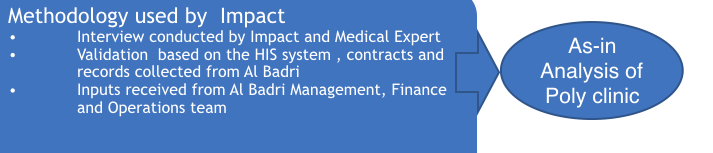

Project Methodology

Project Benefits

- Based on analysis conducted, EmPact defined the key success factors for the proposed venture as follows:

- In-depth financial analysis to come up with a valuation for the business.

- Develop specific ‘gap themes’ and recommend suitable initiatives/actions targeting each gap theme

- Developed to track and monitor progress of the revenue drivers, profitability drivers on a periodic basis and reprioritizing of the services offered.

Case Studies

- Balance Scorecard Strategy Design & Implementation

- Development of Corporate HR Function

- Development of Policies and Procedures for a Specialized Primary Care Center

- Investigation of a High-Profile Exam Leak for a University in UAE

- Market Study for Hospital

- Valuation Support for a Firm in KSA

- Valuation Report & Business Plan for a Physiotherapy Center

- Valuation & Due Diligence for a Polyclinic

- Strategy Management Office

- Financing Scheme Impact Assessment IV

- Revision of the Strategic Support Grant Scheme

- Entrepreneur Needs Assessment Diagnostic Tool Development for Dubai SME

- Credit Review for Cases Applied Under Govt. Subsidy Program

- Organizational Development Support for a Firm in Bahrain

- Gap Assessment for a Construction Firm in KSA

- Digital Gap Assessment

- Review & Development of Policies and Procedures

- Acute Crisis was Averted in Oil and Gas Company in Bahrain

- Market Study for Hospital

- Valuation Support for a Firm in KSA

- Due Diligence & Valuation for a Landscaping Business

- Valuation Report & Business Plan for a Physiotherapy Center

- Valuation for a Technology Company in the Oil & Gas Sector

- Valuation for an Ecommerce Business

- Valuation & Due Diligence for a Polyclinic

- Viability Analysis of a Shipping and Marine Services Company

- Medical Laundry Tender Bid

- Debt Mandate for a Real Estate Development Project in Bahrain

- PMO & Restructuring of a Health & Wellness Group Company

- CFO Services for a Health & Wellness Group Company

- Identifying Financial Mismanagement of a Trading Company